Basic Investment Options

There are various ways and reasons available to invest money. You may invest for your retirement, for child's marriage or to fulfill any of your desire.

But, there are some instruments in which you must invest to have a secured future and still have cash for hard times. So, before you plan to start investing for your future needs, you must look at the basic and essential investment instruments that will help you and your family in case of any emergency or if some unfortunate happens to you.

First thing that you must have is 'Health Insurance'. Having a health insurance is really essential as you never know what may happen to you next year or so. You must take health insurance of each and every member of your family as health expenses are really going high day by day.  So, if something happens to you or any of your family members, a major portion of your savings can go in treatment and other procedures. But, if you do have a health insurance policy, you need not worry much and the insurance cost is also not that high. You may also increase your health insurance limit any time you want, you just need to pay some extra money and you can secure your health and thus your savings and investments.

So, if something happens to you or any of your family members, a major portion of your savings can go in treatment and other procedures. But, if you do have a health insurance policy, you need not worry much and the insurance cost is also not that high. You may also increase your health insurance limit any time you want, you just need to pay some extra money and you can secure your health and thus your savings and investments.

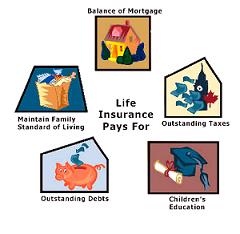

Another plan you must have is 'Life Insurance'. You should plan for your family in case something unfortunate happens to you. You need to analyze and find out how much money your family should have to meet their basic necessities for at least some years. For Life Insurance, you must take a term plan, and do not take other products which offers money back along with Life Insurance cover. Go for a separate plan for Life Insurance and 'do not mix Insurance with Investments'. Treat Insurance as an investment for your family.

These are two basic investments that many people generally ignore and later find them useful when they already paid a huge medical bill from their savings and investments.  Other than that you must have some cash in your savings account, try to put at least 10-15% of your monthly income into your savings account. With-in 10% you can pay premiums for your Health and Life Insurance. 10% of your income you can put in different investment options for your future needs. This way you have secured your health, your family's future and your future needs along with some cash into your savings account. Now 'Enjoy and Live Life like a King' and do not worry much as you have secured yourself and your family in a better way.

Other than that you must have some cash in your savings account, try to put at least 10-15% of your monthly income into your savings account. With-in 10% you can pay premiums for your Health and Life Insurance. 10% of your income you can put in different investment options for your future needs. This way you have secured your health, your family's future and your future needs along with some cash into your savings account. Now 'Enjoy and Live Life like a King' and do not worry much as you have secured yourself and your family in a better way.

Contact us to get the personalized financial advice as per your requirements to secure your future.